You may have heard the terms Home Equity Line of Credit, HELOC, readvanceable mortgage, ‘Smith Manoeuvre’ used by sophisticated investors. It is a popular strategy with sophisticated investors, but how does it actually work?

In simple terms, it is a way to get your ‘dead’ home equity to work for you. Over time, your property will see equity gain from mortgage paydown and real estate market appreciation. This equity is sitting there doing nothing for you. If you are a keen investor, you are very capable of making a return that is much greater than the cost of borrowing, so why not tap into this goldmine?

With real estate investment property, the minimum down payment is 20%, so if you have, for example, $100K in equity available on an existing property, you are able to purchase $500K of property! Amazing! What if this $500K worth of property increased by 1% in one year? That’s about $400/m! Also, don’t forget that the $400K mortgage on your property will have a mortgage paydown component every month, for example, $600/m. Lastly, as a sophisticated investor, after all expenses are paid, including mortgage, emergency fund buffer and the cost of the interest on the HELOC, your property will also yield some cashflow…wow, bonus! To sum up, with well-selected real estate investments, your ‘dead equity’ can significantly be helping you growth your wealth. It can truly be a ‘zero downpayment’ scenario.

One of the most popular vehicles investors use to execute this access to dead equity is the ‘readvanceable mortgage’. It is a beefed up version of the static HELOC (more on that later). Proper setup of a readvanceable mortgage will yield you benefits today and well into the future. (Unfortunately, many Canadians unaware of these opportunities and sitting on equity paralyzed, check out my related blog here)

A readvanceable mortgage consists of various parts, that fall under one ‘umbrella’ or global lending limit. The lender approves you for 80% of the appraised value of your property (you need to have 20% equity in your home to be eligible, as of the rules today). You get approved once, and do not need to get re-approved as long as you are borrowing within your global lending limit. You have a choice on how you split up that loan, a combination between the traditional ‘principal plus interest (P+I) payment’ mortgage, and ‘interest only’ HELOC. The number of accounts varies between lenders, an example is up to 3 ‘P+I’ mortgages (could be fixed or variable), and up to 3 ‘interest only’ HELOC. The minimum payment on the HELOC is interest only, but you can set it up to pay more if you’d like. The HELOC rate is variable and is expressed as prime plus x%. With the readvanceable mortgage, you usually have the option in the future to move any balance of the HELOC into a P+I mortgage (it would have to be a new mortgage partition, cannot be added to your existing mortgage partition). This flexibility is good, especially if variable rates are increasing and you want the assurance and stability of a fixed rate, for example. The reverse however, cannot be done, can’t convert P+I mortgage into interest only HELOC. The only time you would be able to do that is when your P+I mortgage term completes.

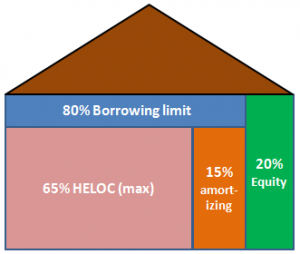

The beauty of the readvanceable mortgage, is, well, it is readvanceable! Every dollar you paydown on your P+I mortgage, advances to your HELOC, which then you can borrow out (and use it to make more money on investments)! Some lenders have this occurring automatically, others you have to put in a request (but the funds are pre-approved). Over time, you can pay off your entire mortgage and have it all sitting in HELOC, available to you. Federally regulated (and most) lenders now restrict the total capacity of a HELOC to 65% of the value, however you can still access up to 80% of your value, the remaining 15% just needs to be in an ‘amortized’ vehicle, ie. a P+I mortgage. The intent of this rule is to encourage people to pay down the debt rather than simply paying interest only. I agree, that is a wise move to pay it down if you are buying frivolous things like cars, boats and consumer items, but for a responsible investor with self-control, this rule is a hindrance. But alas, investors are rarely understand, they are part of the minority, and unfortunately subject to the rules of the majority. Here is a graphic representation of the breakdown:

Example with numbers:

Home value: $300K

Borrowing limit: 80% of $300K = $240K

Maximum HELOC: 65% of $300K = $195K, remaining $45K must be a P+I mortgage

Client chooses the following breakdown:

Fixed rate mortgage: $75K, monthly P+I payments, with principle flowing into HELOC

Variable rate mortgage: $75K, monthly P+I payments, with principle flowing into HELOC

HELOC account #1 (personal): $20K, client choosing to pay fixed monthly amount, more than the minimum interest only

HELOC account #2 (investing): $70K, client choosing to pay interest only

Combined HELOC limit will be $195K

So why do people use this product? It’s a beautiful balance of paying down your mortgage and having flexible access to equity for investment purposes. In Canada, your primary residence mortgage interest is not tax deductible. The readvanceable mortgage shifts this interest into the HELOC, which, if you use for investment purposes, can be tax deductible (please consult your accountant, I am not a tax advisor. If you want to get fancy and complex, look up the ‘Smith Manoeuvre’). Having access to a HELOC gives you flexibility: you can use it for downpayments on property purchases, renovations, real estate emergency fund, family emergency fund, education , alternative to high interest credit cards, car loans, business loans. With a HELOC, interest is charged only on the balance, not the entire limit (unless you max it out, of course).

It is optimal to have it set up before you need it, and before you start acquiring more investment property mortgages, as it more difficult to get approved with existing debt load. Also, with today’s ever-changing lending landscape, and reflecting back on the rules that have already changed, it is very possible that this type of product can be further restricted or possibly phased out. Today, readvanceable mortgages are available mostly for your primary and secondary residence, few lenders now offer on rental property. Lastly, getting it set up today, secures you the premium charged on your HELOC rate (ie. the amount you pay above prime rate). Currently, lenders are offering favourable premiums on their HELOC, they may decide to raise their premiums in the future.

Lenders call their readvanceable products by different names, claiming exclusivity to this concept, but in general, it is a similar idea. However, there are some nuances between the products, that can make a huge difference to investors in particular, that is why it is best to work with a mortgage broker familiar with the differences. There are many layers to this product, very often poorly explained to the consumer, many consumers are unaware of the benefits and risks. One example is making sure you have the flexibility of splitting up HELOC accounts between personal and investments, to ensure proper tracking of tax deductible interest. Canada Revenue Agency can make it a field day on this one, major pitfall for investors!

Readvanceable mortgages often get confused with ‘standalone’ or ‘static’ HELOC products. Those are also available, however, it is more of a snapshot type of loan. You get approved for a limit at the time of application, and even if you pay down your first mortgage or your home value goes up, your limit does not increase. Still useful for investing purposes, but not as flexible.

Another confusion is the notion that this is simply a ‘personal line of credit’, and that no legal process is required. HELOC is secured against your home, therefore registration against your property is required, and has to involve a lawyer (even if you don’t deal with lawyer directly, the legal stuff gets done behind the scene). The HELOC is registered like a mortgage, and it is a mortgage product. The benefit of having the loan secured is that you get a very good interest rate, compared to an unsecured loan.

Readvanceable mortgages and HELOCs are not for everybody. There are risks and restrictions, that are not necessarily deal breakers, but you should be aware of. Getting approved for a readvanceable mortgage is more difficult than a traditional mortgage. You can say that essentially you need to prove to the lender that you don’t need the money to get the money, so this strategy is best done early on in your investment journey before accumulating a large real estate portfolio. Also, a refinance into a simple first mortgage may be a better option, with cash out instead of using an interest bearing HELOC. Everyone’s overall specific situation is different, this is where proper mortgage planning is needed.

You need to be comfortable with leverage and investing in general. This is not for people who want absolute guaranteed safety. But with no risk, there is no reward. Real estate, is one of the safest investment vehicles, in my opinion. The proof is with the lenders, willing to loan you money at 20% downpayment (or less), a 5 to 1 leverage ratio. Using your home equity and leveraging it wisely and effectively for wealth growth can make the difference between you having a good life and you having a great life.